All Categories

Featured

Table of Contents

One of the vital facets of any kind of insurance coverage plan is its cost. IUL policies often come with numerous charges and costs that can influence their general value.

Yet don't just think about the premium. Pay specific focus to the plan's features which will certainly be essential relying on how you wish to use the plan. Talk with an independent life insurance coverage agent that can assist you select the ideal indexed universal life plan for your requirements. Total the life insurance policy application in full.

Testimonial the plan carefully. If adequate, return authorized distribution receipts to obtain your universal life insurance policy protection active. After that make your first costs payment to trigger your policy. Currently that we have actually covered the benefits of IUL, it's important to understand just how it contrasts to various other life insurance plans available in the marketplace.

By recognizing the resemblances and differences in between these plans, you can make an extra educated decision regarding which sort of life insurance policy is best suited for your requirements and economic goals. We'll begin by comparing index global life with term life insurance policy, which is typically taken into consideration the most uncomplicated and budget friendly sort of life insurance coverage.

Iul Account Value

While IUL might give higher possible returns due to its indexed cash value growth device, it additionally comes with greater costs contrasted to describe life insurance policy. Both IUL and entire life insurance policy are kinds of long-term life insurance policy plans that provide survivor benefit defense and cash worth development chances (Indexed Universal Life loan options). Nevertheless, there are some crucial differences between these two kinds of plans that are very important to take into consideration when making a decision which one is ideal for you.

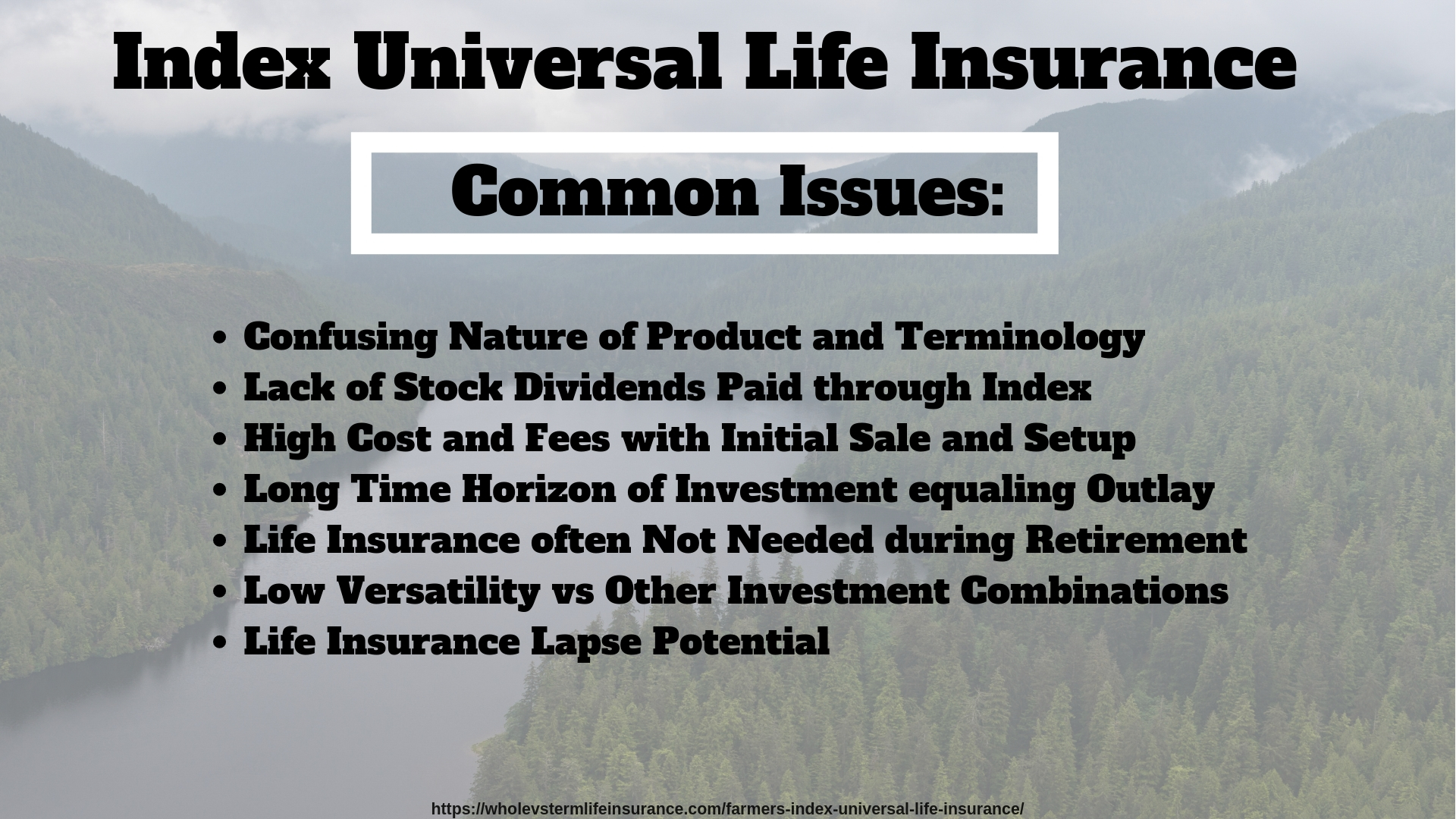

When considering IUL vs. all various other sorts of life insurance policy, it's vital to weigh the pros and disadvantages of each plan kind and seek advice from an experienced life insurance policy agent or financial adviser to figure out the ideal option for your special needs and financial objectives. While IUL supplies many advantages, it's additionally crucial to be familiar with the threats and considerations associated with this kind of life insurance plan.

Allow's dig deeper right into each of these dangers. Among the key worries when considering an IUL policy is the different prices and fees connected with the policy. These can include the cost of insurance, plan fees, surrender fees and any kind of extra cyclist costs incurred if you add extra benefits to the policy.

Some may provide more affordable prices on protection. Check the financial investment choices readily available. You desire an IUL policy with an array of index fund options to satisfy your needs. See to it the life insurance provider straightens with your personal financial objectives, requirements, and threat resistance. An IUL policy must fit your particular scenario.

Who has the best customer service for Guaranteed Interest Iul?

Indexed global life insurance can offer a variety of advantages for policyholders, including flexible premium repayments and the possible to earn greater returns. However, the returns are limited by caps on gains, and there are no guarantees on the marketplace efficiency. Overall, IUL policies use numerous possible benefits, but it is very important to understand their risks as well.

Life is not worth it for a lot of individuals. It has the capacity for large financial investment gains yet can be unpredictable and costly contrasted to conventional investing. Furthermore, returns on IUL are typically low with considerable charges and no guarantees - Long-term IUL benefits. Generally, it relies on your needs and objectives (High cash value Indexed Universal Life). For those seeking predictable long-lasting savings and assured survivor benefit, entire life might be the far better alternative.

Is Guaranteed Iul worth it?

The advantages of an Indexed Universal Life (IUL) policy include prospective greater returns, no drawback risk from market activities, protection, adaptable repayments, no age need, tax-free survivor benefit, and loan schedule. An IUL policy is irreversible and offers cash money value growth via an equity index account. Universal life insurance policy began in 1979 in the United States of America.

By the end of 1983, all major American life insurance providers used global life insurance coverage. In 1997, the life insurance company, Transamerica, introduced indexed universal life insurance policy which offered insurance holders the capacity to link policy growth with global securities market returns. Today, global life, or UL as it is likewise known can be found in a range of various kinds and is a huge part of the life insurance market.

The details provided in this post is for academic and informational objectives just and must not be construed as financial or financial investment recommendations. While the author possesses expertise in the topic, viewers are encouraged to speak with a certified financial consultant prior to making any kind of investment choices or acquiring any type of life insurance policy items.

How can I secure Long-term Iul Benefits quickly?

You might not have actually assumed a lot regarding just how you desire to spend your retired life years, though you probably understand that you do not desire to run out of cash and you 'd like to keep your existing lifestyle. < map wp-tag-video: Text shows up following to business male speaking with the electronic camera that reads "company pension", "social safety" and "savings"./ wp-end-tag > In the past, individuals trusted three primary resources of earnings in their retirement: a business pension plan, Social Safety and whatever they 'd taken care of to save

Fewer employers are supplying conventional pension plan strategies. And numerous firms have actually decreased or terminated their retired life plans. And your capability to count entirely on Social Protection remains in concern. Also if advantages have not been reduced by the time you retire, Social Protection alone was never intended to be adequate to spend for the lifestyle you desire and are entitled to.

Before dedicating to indexed universal life insurance policy, here are some advantages and disadvantages to consider. If you select a great indexed universal life insurance policy strategy, you may see your cash money worth expand in worth. This is valuable since you might be able to accessibility this cash before the strategy runs out.

How do I cancel Indexed Universal Life Death Benefit?

If you can access it beforehand, it might be valuable to factor it into your. Because indexed global life insurance needs a specific level of threat, insurer have a tendency to keep 6. This kind of strategy also provides. It is still guaranteed, and you can adjust the face quantity and riders over time7.

If the selected index does not perform well, your cash money value's development will certainly be impacted. Commonly, the insurer has a beneficial interest in executing much better than the index11. There is typically a guaranteed minimum interest price, so your strategy's growth will not fall below a certain percentage12. These are all variables to be considered when selecting the most effective kind of life insurance policy for you.

Since this type of plan is a lot more complex and has an investment element, it can usually come with greater costs than other plans like entire life or term life insurance coverage. If you don't think indexed universal life insurance coverage is right for you, below are some choices to consider: Term life insurance policy is a short-lived plan that usually provides coverage for 10 to three decades

Latest Posts

Nationwide Iul

Cost Of Insurance Universal Life

No Lapse Universal Life